The Semiconductor Shortage: How We Got Here and What’s Next

There is one topic on the mind of automotive and supply chain professionals this spring: semiconductors. These small, high-tech materials have caused a large ripple effect that is shutting down production lines, stretching dealer inventory, and sending used car values to record highs. Let’s discuss why these materials are so important to today’s vehicles, how the shortage came to be, and what’s ahead for fleets.

What are Semiconductors, and Why Do They Matter to OEMS?

Semiconductors are wafers made of materials with specifically designed conductivity properties. They are a critical component of microchips (also called integrated circuits). Today’s vehicles need hundreds to thousands of microchips to function, and today’s vehicles are relying more and more on electronics that are made with semiconductors.

How Did We Get Here?

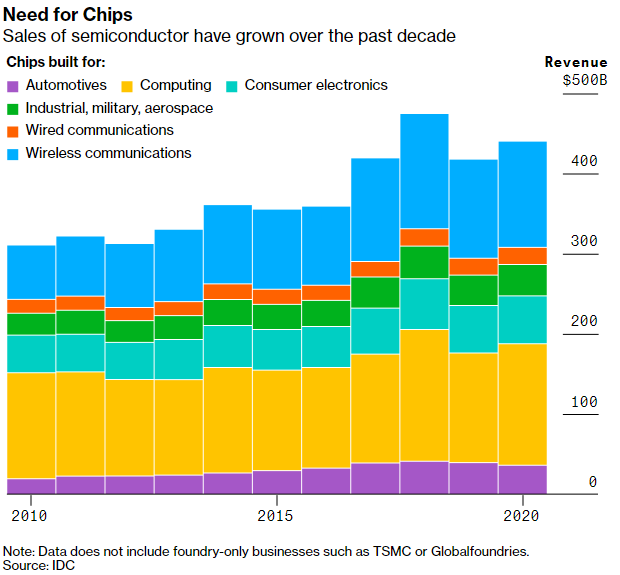

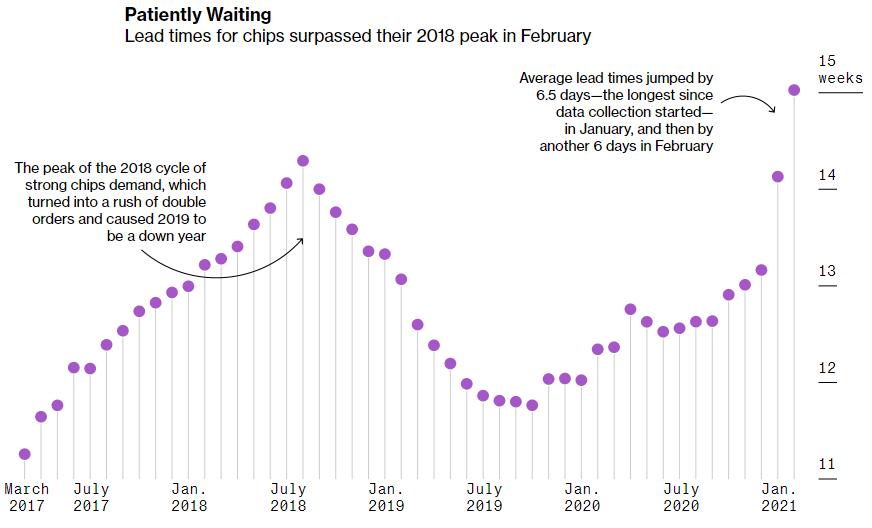

In a way, the supply chain challenge surrounding semiconductors and the microchips that require them is not new. For two decades, supply lagged behind demand, with a peak in demand occurring in 2018. The past year has delivered a sequence of events that has exacerbated the challenge. Production of both microchips themselves and vehicles were reduced due to the COVID pandemic, so auto manufacturers reduced their chips orders. However, while there was an initial reduction in demand for microchips, the demand quickly spiked among non-automotive industries. As they placed their orders, automotive manufacturers were slow to react and now essentially are at the back of the line.

Further complicating the landscape for fleets is that in the big picture, the automotive industry drives a small part of overall semiconductor market demand. Smart phones, high-performance computers, and wireless communications dominate revenues, while automotive chips only comprise 10% of semiconductor demand.

Compounding matters was a fire mid-March at Renesas, a leading auto microchip manufacturer, and production delays in Japan in February due to an earthquake. Not only were auto manufacturers hit by these delays in microchip output, but vehicle assembly timelines were also negatively impacted by extreme weather in Texas early this winter.

What’s Next?

According to various industry projections, the semiconductor shortage and the resulting fallout are here to stay for at least this year. According to Bloomberg, data from some of the largest chipmakers show lead times continuing to increase, with some microprocessor lead times jumping to 17 weeks from 10 weeks.

At the same time, demand for chips is expected to increase further as more people demand 5G technology and vehicles themselves become more technologically sophisticated. The largest semiconductor supplier is expecting a 23% increase in sales this year. Meanwhile, 75% of semiconductor parts have also had a jump in lead times. A report by Gartner estimates that impacts of this supply-demand mismatch could last through 2021 and potentially beyond, with production down by 1.3 million units.

The semiconductor industry and governments have been mobilizing to address the issue. President Biden has recently called for the United States to invest in its semiconductor infrastructure to help address the challenge, and the Taiwan Semiconductor Manufacturing Company (TMSC), who produces the majority of automotive microcontrollers, announced $100 billion of investments to expand its capacity over the next three years. However, scaling up manufacturing capacity and related infrastructure will take years.

What Does It Mean for My Fleet’s Vehicle Acquisitions?

According to a report from Gartner, the bottom line is this: supply chain and automotive procurement leaders must have a long-term, multisource strategy to minimize the impacts of disruptions. Short-term reactions may alleviate the current burden but ultimately will not solve the larger-scale problem.

In the meantime, fleet managers are faced with a difficult acquisitions landscape and must adapt accordingly. The core thing to remember is that, whether you are placing factory orders, securing vehicles from dealerships, or building bailment pools, act decisively and with urgency. Hesitation can often be the difference between securing a vehicle and losing it to another person or company who moved faster.

Flexibility will also take your fleet a long way. Exploring alternative models and OEMs, pre-ordering vehicles when possible, and even taking small steps like cutting back on spare key requests (key fobs also use semiconductors) can all make an impact.

During this period, we’re also encouraging fleets to collaborate closely with their fleet management partner, and to stay informed as much as possible. Merchants recently put together a guide on hot to manage order delay, questions to ask yourself when planning, and tips for building a successful acquisition strategy. You can download it here. We are also posting regular updates here on production delays, closures, and other semiconductor-related news.

This may be a challenging period for acquisitions, but with innovative thinking and collaboration, we can keep fleets on the road.