- About

About

When you learn to overcome fear, you step into a place of empowerment in your life and your career.

You have the opportunity to conquer fear, thrive in uncertainty and shut the door to doubt. I’ve seen thousands and thousands of people do it. You have the ability to truly be fearless.

Brendan P. Keegan

- Books

Books

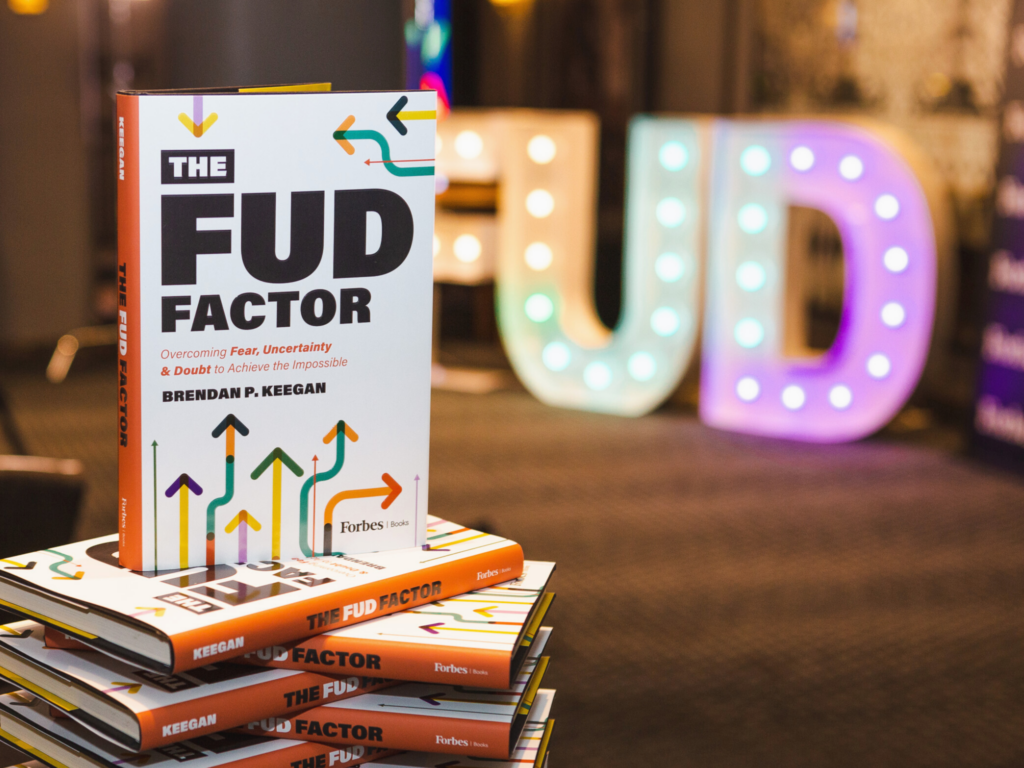

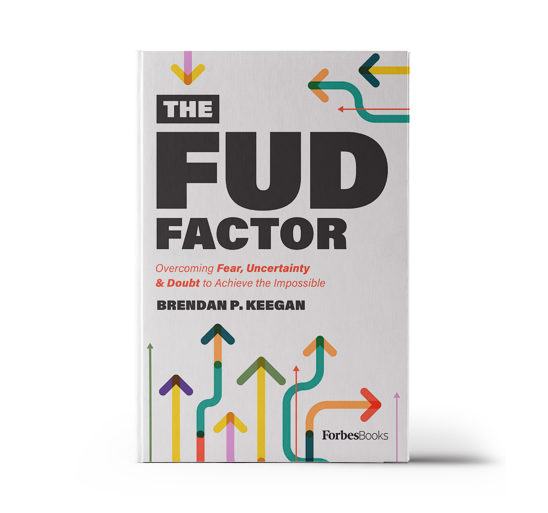

Brendan breaks through the boredom barrier with gripping stories, eye-opening insights and skill-building strategies you’ll actually use.

Available Now-

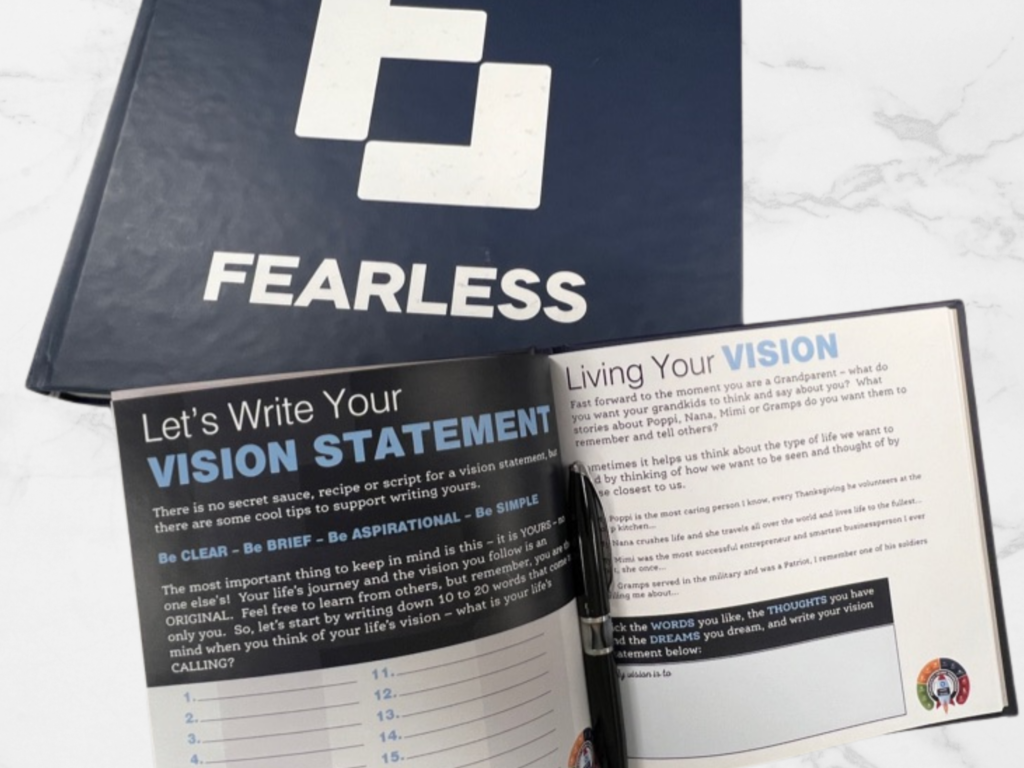

Fearlessly 4wardFiercely focused and remarkably practical, the Fearlessly 4ward workbook guides you through a series of exercises for activating your life across the 12 dimensions most critical to personal and professional success. Designed for the long haul, the workbook gives you the tools to create and achieve your four-year fearless leadership plan.

Fearlessly 4wardFiercely focused and remarkably practical, the Fearlessly 4ward workbook guides you through a series of exercises for activating your life across the 12 dimensions most critical to personal and professional success. Designed for the long haul, the workbook gives you the tools to create and achieve your four-year fearless leadership plan. -

- Speaking

Speaking

Brendan is not your typical corporate speaker. That’s because he delivers tangible, pragmatic insights grounded in real-life stories and examples.

TopicsThe Transformation Playbook: 8 Steps to Business Transformation

View Keynote Details

Revving Up Your Growth Engine Through Relationship Management

View Keynote Details

- Podcasts

Podcasts

Podcasts that share Brendan's experiences as well as the stories of other fearless leaders.

Recent Conversations-

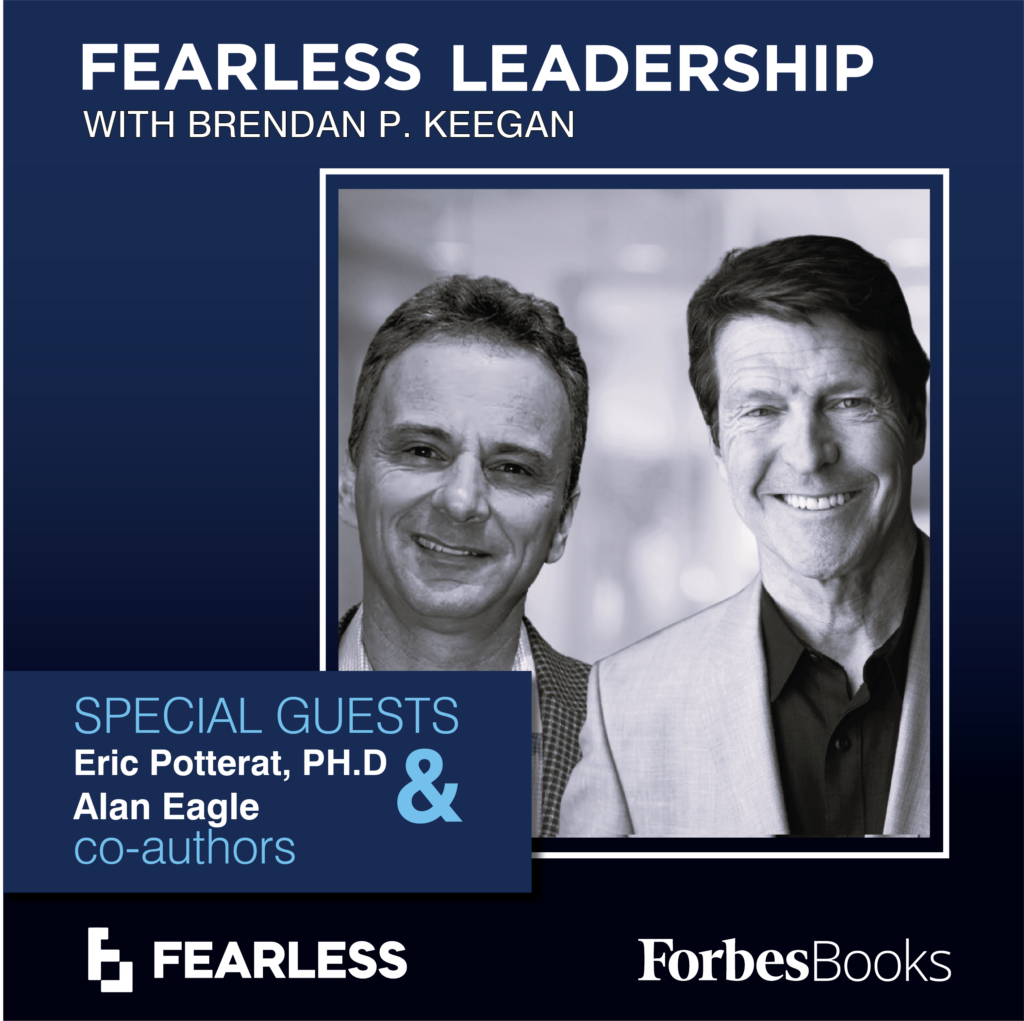

Fearless Leadership ft. Eric Potterat PH.D & Alan EagleDrawing on their decades of experience training top business executives, athletes, and Special Forces operators, Eric and Alan reveal the cognitive skills and mental frameworks that allow people to optimize performance despite chaos and uncertainty.

Fearless Leadership ft. Eric Potterat PH.D & Alan EagleDrawing on their decades of experience training top business executives, athletes, and Special Forces operators, Eric and Alan reveal the cognitive skills and mental frameworks that allow people to optimize performance despite chaos and uncertainty. -

Fearless Leadership ft. Saha DiGiulianAt just 30 years old, Sasha has cemented herself as the most accomplished female rock climber in the world. Dive into Sasha's record-breaking career, her perspective on being a woman in a male-dominated sport, and her advice for young people looking to follow their dreams.

Fearless Leadership ft. Saha DiGiulianAt just 30 years old, Sasha has cemented herself as the most accomplished female rock climber in the world. Dive into Sasha's record-breaking career, her perspective on being a woman in a male-dominated sport, and her advice for young people looking to follow their dreams.

- Publications

Articles

Check out Brendan's articles featured in publications like Inc, Entrepreneur, Fast Company, Newsweek and more.

Featured ArticleBlog

From business success stories to how to be more productive - hear what is on Brendan's mind.

Latest Post- Giving

- Investments

- About

About

When you learn to overcome fear, you step into a place of empowerment in your life and your career.

You have the opportunity to conquer fear, thrive in uncertainty and shut the door to doubt. I’ve seen thousands and thousands of people do it. You have the ability to truly be fearless.

Brendan P. Keegan

- Books

Books

Brendan breaks through the boredom barrier with gripping stories, eye-opening insights and skill-building strategies you’ll actually use.

Available Now-

Fearlessly 4wardFiercely focused and remarkably practical, the Fearlessly 4ward workbook guides you through a series of exercises for activating your life across the 12 dimensions most critical to personal and professional success. Designed for the long haul, the workbook gives you the tools to create and achieve your four-year fearless leadership plan.

Fearlessly 4wardFiercely focused and remarkably practical, the Fearlessly 4ward workbook guides you through a series of exercises for activating your life across the 12 dimensions most critical to personal and professional success. Designed for the long haul, the workbook gives you the tools to create and achieve your four-year fearless leadership plan. -

- Speaking

Speaking

Brendan is not your typical corporate speaker. That’s because he delivers tangible, pragmatic insights grounded in real-life stories and examples.

TopicsThe Transformation Playbook: 8 Steps to Business Transformation

View Keynote Details

Revving Up Your Growth Engine Through Relationship Management

View Keynote Details

- Podcasts

Podcasts

Podcasts that share Brendan's experiences as well as the stories of other fearless leaders.

Recent Conversations-

Fearless Leadership ft. Eric Potterat PH.D & Alan EagleDrawing on their decades of experience training top business executives, athletes, and Special Forces operators, Eric and Alan reveal the cognitive skills and mental frameworks that allow people to optimize performance despite chaos and uncertainty.

Fearless Leadership ft. Eric Potterat PH.D & Alan EagleDrawing on their decades of experience training top business executives, athletes, and Special Forces operators, Eric and Alan reveal the cognitive skills and mental frameworks that allow people to optimize performance despite chaos and uncertainty. -

Fearless Leadership ft. Saha DiGiulianAt just 30 years old, Sasha has cemented herself as the most accomplished female rock climber in the world. Dive into Sasha's record-breaking career, her perspective on being a woman in a male-dominated sport, and her advice for young people looking to follow their dreams.

Fearless Leadership ft. Saha DiGiulianAt just 30 years old, Sasha has cemented herself as the most accomplished female rock climber in the world. Dive into Sasha's record-breaking career, her perspective on being a woman in a male-dominated sport, and her advice for young people looking to follow their dreams.

- Publications

Articles

Check out Brendan's articles featured in publications like Inc, Entrepreneur, Fast Company, Newsweek and more.

Featured ArticleBlog

From business success stories to how to be more productive - hear what is on Brendan's mind.

Latest Post- Giving

- Investments

- Books

- Books

Welcome to your Fearless Leadership Journey

Join the hundreds of thousands of people Brendan P. Keegan has developed, coached, and inspired with his simple, systematic approach to accomplishing great things by overcoming fear, uncertainty, and doubt.

Explore hundreds of free resources

Why bFearless?

Fear, uncertainty, and doubt are universal human reactions designed to keep us safe. But in today’s world, more often than not, fear does nothing but hold us back from our own greatest potential.

Visionary leader Brendan P. Keegan knows exactly what it means to triumph over fear in both life and work. He has made it his mission to share his actionable insights and experiences to help build one million fearless leaders. If you are ready to take a leap, Brendan is here to help you stick the landing.

The bFearless Mission

Fear

is only as strong as you allow it to be

Uncertainty

is only as strong as you allow it to be

Make Fearless Leadership Possible for Everyone

Explore by Topic

Join the Fearless Leadership Movement

Discover how Brendan can help you or your organization thrive through fearless leadership.